Borrowing For Next Semester?

Choose a student loan built for you.

A Union Federal® Private Student Loan, powered by Cognition Financial, gives you options so you can rest assured you’re doing the right thing for your future. Prequalify 1 today with no impact to your credit score.

Did you know?

An application is 4 times more likely to be approved with a cosigner.

A creditworthy cosigner with a strong credit history increases your chances of getting approved and getting a lower rate.

Interest Rates:

Union Federal Private Student Loan interest rates are competitive in the industry. Rates are determined by the borrower’s and the cosigner’s, if applicable, credit histories, the repayment option, and the loan term selected, the expected number of years in deferment, the requested loan amount, and other information provided on the online loan application.

Am I eligible?

A Union Federal Private Student Loan covers up to 100% of your school-certified cost of attendance, which typically includes things like tuition and fees, books and supplies, room and board, transportation and personal expenses.

Eligibility requirements for the student

- Be enrolled at least half-time at an eligible institution in a degree-granting program

- Be the legal age of majority, or at least 17 years of age at the time of application if applying with a cosigner who meets the age of majority requirements in the cosigner’s state of residence 9

- Be a U.S. citizen or permanent resident, or an eligible international student applying with a qualified cosigner who is a U.S. citizen or permanent resident alien

- The Union Federal Private Student Loan is not available to students or cosigners whose permanent residency state is Arizona, Iowa or Wisconsin.

Cosigners are very important

Applying with a cosigner increases your chance of approval by 4 times, and if your cosigner has good credit history, you may get a better rate. A cosigner can be an eligible parent, guardian, friend, etc.

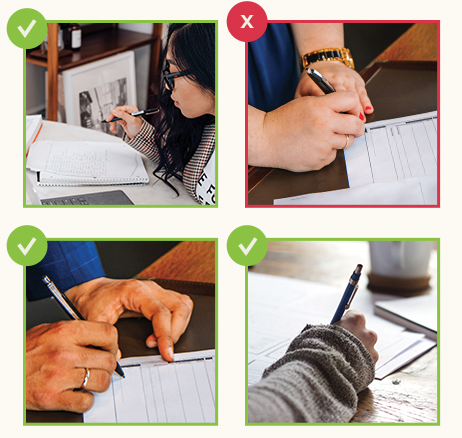

Prequalification checklist

We now offer prequalification! 1 You and your cosigner can now quickly check your rate without any impact to your credit scores.

You can use this checklist to help you complete that process.

- Personal information (name, Social Security number, date of birth)

- Address (mailing address and permanent address)

- Phone number(s)

- Email address

- School information (name of school, cost of attendance, grade level, expected graduation date)

- Loan information (amount needed and when)

- Income information for the cosigner or student (on a cosigned loan, income is not required of the student but is of the cosigner; for a student applying on their own, income is required of the student)

Multiple loan options

Ways to decrease your rate

Still have questions?

Contact Us

To speak with a Union Federal Private Student Loan Specialist: 866-513-8445

To email a Union Federal Private Student Loan Specialist: info@unionfederalstudentloans.com

Union Federal Private Student Loans at a Glance

A Union Federal Private Student Loan covers up to 100% of your school-certified cost of attendance, which typically includes things like tuition and fees, books and supplies, room and board, transportation and personal expenses.

Eligibility requirements for the student

- Be enrolled at least half-time at an eligible institution in a degree-granting program

- Be the legal age of majority, or at least 17 years of age at the time of application if applying with a cosigner who meets the age of majority requirements in the cosigner’s state of residence 9

- Be a U.S. citizen or permanent resident, or an eligible international student applying with a qualified cosigner who is a U.S. citizen or permanent resident alien

- The Union Federal Private Student Loan is not available to students or cosigners whose permanent residency state is Arizona, Iowa or Wisconsin.

Applying with a cosigner increases your chance of approval by 4 times, and if your cosigner has good credit history, you may get a better rate. A cosigner can be an eligible parent, guardian, friend, etc.

We now offer prequalification! 1 You and your cosigner can now quickly check your rate without any impact to your credit scores.

You can use this checklist to help you complete that process.

- Personal information (name, Social Security number, date of birth)

- Address (mailing address and permanent address)

- Phone number(s)

- Email address

- School information (name of school, cost of attendance, grade level, expected graduation date)

- Loan information (amount needed and when)

- Income information for the cosigner or student (on a cosigned loan, income is not required of the student but is of the cosigner; for a student applying on their own, income is required of the student)

Contact Us

To speak with a Union Federal Private Student Loan Specialist: 866-513-8445

To email a Union Federal Private Student Loan Specialist: info@unionfederalstudentloans.com